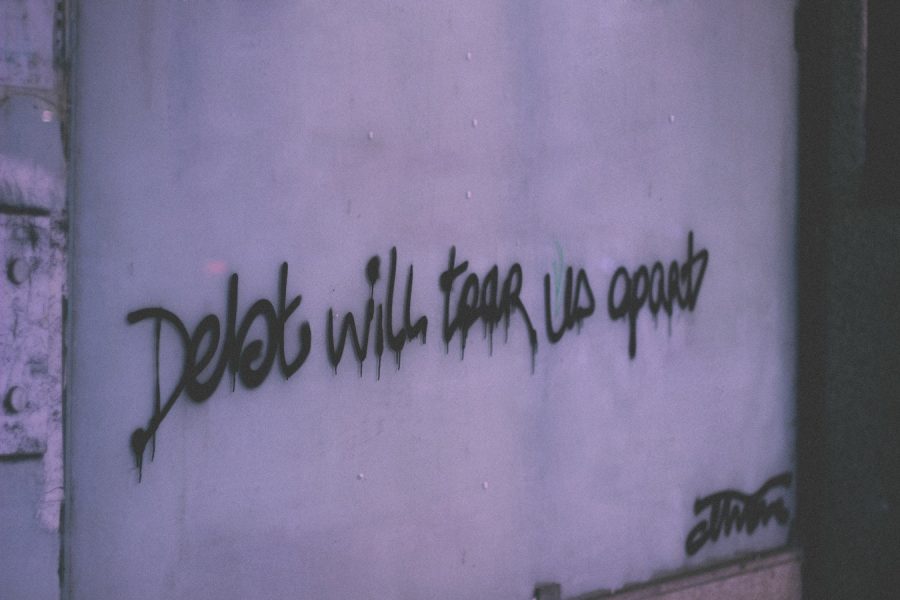

National debt crisis

December 21, 2018

110 percent greater than the county’s own GDP, the U.S is $21 trillion dollars deep down in debt and is estimated to enter the $22 trillion dollar mark in early 2019 with a yearly budget deficit trailing right behind–making it currently the country with the largest amount of debt in the world by record numbers.

Starting from 1970, a yearly budget deficit (budget deficit is when, in this case, the government is spending more than there is available revenue to cover the cost) has consistently been an issue at hand. From the increase of military funding of which lies at $700 billion dollars to the exponential increased cost of Medicare and Social Security, the rate has only gotten worse.

Because of such deficits, in order to manage through, the government relies on investors and taxes to alleviate the damaging circumstance(s).

Historically, interest rates have been at the low, but as present day nears, the budget deficit grew, including the interest that is placed on it. Credibility is one thing, but reputation is another. For if the government were to not pay their debt back, mutual trust between their investors and other populace(s) will also bare such mentality, causing probable unpredictable and harmful repercussions in return.

Though many experts say that purposeful budget deficit can be used to promote a stronger and wealthier economy to later gain huge profit in the short and/ or long term, it is not

without say that there is a certain limit to such a degree of spending. According to the study found by the World Bank, they concluded that if the ratio between debt-to-GDP ratio exceeded 77 percent for a prolonged amount of time, and thus on the contrary, even led to a slower economic growth.

This directly relates to the situation that the U.S is in as they are currently sitting at 110 percent which is significantly larger than the scale tested.

With problems come hopeful solutions, and on the bare surface, cutting spending(s) may seem like a reasonable option that may fix or ease the dilemma. But if that were to happen, growth in terms of the economy would be slowed down due to less funding, support, and opportunities. In fact, the problem has escalated past the tipping point by a long shot meaning there is no practical solution to such a devastating economic problem anymore.

In the end, 2019 will be one ludicrous ride with the national debt growing at an unprecedented rate. America needs to wake up before it regrets sleeping on its bills.

Sources

https://theweek.com/articles/747998/national-debt-explained

https://www.thebalance.com/debt-to-gdp-ratio-how-to-calculate-and-use-it-3305832

https://www.thebalance.com/will-the-u-s-debt-ever-be-paid-off-3970473